The Psychology of Buying: A Guide to Qualitative Customer Research

If you've ever stared at a spreadsheet full of numbers and wondered what your customers were actually thinking, you've felt the gap that qualitative research is designed to fill. It's the art of digging into the why behind the data—the crucial step that transforms generic marketing into a sophisticated, revenue-generating strategy.

Your analytics might tell you that 70% of shoppers abandon their carts—that's the what. But qualitative research is what tells you why. Is the shipping cost a surprise? Is the checkout confusing? Do they not trust your site? Answering these questions is the difference between guessing and knowing, and it's where the real ROI is found.

Beyond Numbers: Why Qualitative Research Is Your E-commerce Superpower

It’s easy to get lost in the sea of quantitative data—conversion rates, click-throughs, and AOV. These numbers are great for spotting trends, but they rarely tell the full story. They're like a smoke alarm telling you there's a fire, but not where it is or what started it.

This is where qualitative customer research steps in, giving you a direct line to the real human stories, motivations, and frustrations behind the numbers. It helps you understand the psychological principles at play: the scarcity that makes a shopper feel a sense of urgency, the social proof they need to feel confident, or the friction points that trigger loss aversion and cause them to abandon a purchase.

From Insight to Revenue

The real power here is how quickly these "why" insights translate into ROI and protect profit margins. When you uncover what truly motivates your customers, you can stop guessing and start making smarter, more profitable decisions. You're no longer just throwing discounts at a problem; you're solving the core psychological issue that's holding back your sales and protecting your inventory from markdowns.

This isn’t just a nice-to-have, either. The industry is waking up to the power of the 'why'. The recent GRIT Report found that over 57% of researchers see a huge surge in demand for qualitative methods. It's becoming so critical that 51% of research budgets are now dedicated to it, a massive jump that shows just how valuable these insights are. You can learn more about how brands are using these insights to understand the building blocks of consumer behavior.

By focusing on the 'why,' you stop reacting to data and start anticipating customer needs. This proactive stance is the foundation of sophisticated marketing that resonates emotionally and drives measurable financial results.

To really see how these two research types work together, let's break down their core differences.

Qualitative vs Quantitative Research for E-commerce

Think of quantitative research as your wide-angle lens, showing you the big picture of what's happening across your entire store. Qualitative research is your zoom lens, letting you focus on the tiny, crucial details of individual customer experiences. One tells you that a problem exists; the other tells you how to fix it.

Here’s a practical look at how they compare:

| Aspect | Qualitative Research (The 'Why') | Quantitative Research (The 'What') |

|---|---|---|

| Questions Answered | Why are customers abandoning carts? What do they feel about our brand? What's stopping them from buying? | How many people abandoned their carts? What is our conversion rate? Which button gets more clicks? |

| Data Type | Stories, opinions, emotions, direct quotes | Numbers, statistics, percentages, metrics |

| Sample Size | Small and focused (5-15 people) | Large and statistically significant (hundreds or thousands) |

| Methods | Interviews, usability tests, focus groups, diary studies | A/B tests, website analytics, surveys with closed-ended questions |

| Business Impact | Uncovers deep motivations to improve messaging, user experience, and product positioning. | Measures performance, tracks KPIs, and identifies large-scale trends. |

| Best For | Exploring complex problems, generating new ideas, and understanding customer psychology. | Validating hypotheses, measuring the impact of changes, and reporting on business health. |

While quantitative data flags the issues, qualitative insights give you the roadmap to solve them. You need both to build a truly customer-centric e-commerce brand.

The Foundation of Advanced Urgency Marketing

Ultimately, the insights you pull from qualitative research are pure gold for creating urgency that actually works. Anyone can slap a countdown timer on a page, but basic triggers like that are easily ignored and fail to generate meaningful revenue. They're a blunt instrument in a world that requires surgical precision.

A strategy built on real consumer psychology, however, creates marketing that feels personal, relevant, and compelling. This is where Quikly excels, turning deep psychological insights into automated "Moments" that enhance the entire shopper journey. It’s the difference between shouting "SALE!" and deploying a sophisticated behavioral trigger at the perfect time.

When you really get what drives your customers, you can:

- Frame Offers Based on Behavioral Economics: Do your shoppers respond more to the fear of missing out (FOMO), or do they get excited by the principle of scarcity and exclusive access?

- Refine Your Messaging: You can ditch generic CTAs and start using the exact words and phrases that speak to your customers' deepest anxieties or biggest aspirations.

- Deploy Smarter Triggers: Forget basic pop-ups focused on email capture. You can build automated campaigns that are psychologically tuned to generate revenue by guiding a shopper from hesitant browsing to confident buying.

This is how you turn urgency from a manipulative tactic into a sophisticated strategy that drives revenue and builds brand affinity.

Powerful Qualitative Research Methods for Shopify Brands

Okay, so you understand the "why" matters. But how do you actually find it? The next step is picking the right tools to pry open those insights, and for Shopify brands, some qualitative methods are absolute goldmines.

These aren't stuffy, academic exercises. Think of them as practical diagnostic tools for figuring out what’s really going on with your customers—the kind of stuff Google Analytics will never tell you.

Each method answers a totally different kind of business question. This gives you a versatile toolkit to explore everything from mysterious friction points on your site to the deep-seated emotions that actually drive someone to click "buy now." By picking the right approach, you're gathering the raw psychological data you need to build urgency that feels genuine, not just a gimmick with a timer.

One-on-One Customer Interviews

This is the classic for a reason. It’s a real, direct conversation with a customer, usually for about 30-60 minutes. This is your chance to get way beyond a 1-to-5 scale and hear the actual stories, the hesitations, and the motivations behind their shopping journey—in their own words.

- What it answers: Why did you pick us over a competitor? What was going through your head right before you purchased? Can you walk me through a time you got frustrated on our site?

- The payoff for retail: Nothing beats an interview for getting to the heart of complex purchase decisions, how people really see your brand, and the emotional backstory of a sale. These conversations directly inform your core messaging so you can speak to real anxieties and desires.

- Actionable Takeaway: Schedule three 30-minute interviews this week with recent customers. Offer a $25 gift card. You'll uncover actionable insights almost immediately.

Website Usability Testing

Picture this: you're looking over a customer's shoulder as they try to do something specific on your Shopify store, like find a particular product or get through checkout. In usability testing, you watch them do exactly that, encouraging them to "think aloud" the entire time. It's like a live feed of their thought process.

- What it answers: Where are people getting stuck in our checkout? Is our navigation actually intuitive? Are our product descriptions clear enough to make someone feel confident about buying?

- The payoff for retail: This is, hands down, the fastest way to find the exact friction points costing you money. Discovering that customers can't find shipping info until the very last step is a multi-thousand-dollar insight you can fix in five minutes. You're literally protecting your profit margin.

- Actionable Takeaway: Use a tool like UserTesting or Maze to run a single usability test on your mobile checkout flow. Pay close attention to moments of hesitation or confusion.

Mobile Ethnography and Diary Studies

This is a more modern, candid approach. You use the customer’s own smartphone to capture their shopping experiences as they happen, right in their natural habitat. They might send you short video clips, snap photos, or jot down journal entries as they browse your site, unbox a package, or actually use your product. It’s like having a documentary crew follow your customer around.

Going digital-first has made these methods way more accessible. In fact, online webcam interviews are now the top qualitative technique, used by 34% of professionals. A massive 87% of researchers in North America now do over half of their qualitative research digitally, a shift driven by the need for the kind of real-time, in-the-moment insights that mobile ethnography delivers. You can dig deeper into these future trends in qualitative market research.

- What it answers: How does our product actually fit into a customer's day-to-day life? What real-world problem are they trying to solve when they land on our store? What's the unboxing experience really like when no one's watching?

- The payoff for retail: Ethnography uncovers the authentic context behind shopping behavior. This is crucial for creating marketing that actually reflects your customer's reality, not just your idea of it. It’s also where you'll find unmet needs that could spark your next big product idea or a perfectly timed urgency campaign.

When you combine these powerful methods, you start to see the whole picture. Usability tests show you where they struggle, interviews reveal why they care, and ethnography shows you how your brand fits into their life.

How to Design Your First Research Study

A well-designed qualitative study doesn't kick off with a list of questions; it starts with a clear, revenue-focused business objective. Before you even think about talking to a customer, you have to nail down the exact problem you're trying to solve. If you skip this step, you’ll end up with a pile of interesting stories but zero actionable insights.

Think of it like a doctor trying to make a diagnosis. They don't just ask random questions about your health. They start with a specific symptom—let's say, a high cart abandonment rate—and then form a hypothesis to investigate. Your business goal is that symptom.

Start with a Tangible Business Goal

Your objective needs to be a specific, measurable problem that hits your bottom line. Steer clear of vague goals like "learn what customers think." Instead, anchor your research to a concrete business challenge. To really get this right, you have to master the UX research process to ensure your studies are solid and actually produce valuable information.

Here are a few examples of strong, ROI-driven research objectives for a Shopify brand:

- Inventory Management: "Understand which product features our customers value most in the new collection so we can avoid over-investing in unpopular stock."

- Profit Margin Protection: "Discover why shoppers are abandoning carts filled with our highest-margin items."

- Conversion Rate Improvement: "Identify the main sources of friction and anxiety during our mobile checkout that are causing people to drop off."

Objectives like these give your study a clear direction. They make sure the insights you gather can be tied directly back to financial outcomes, creating a straight line from customer feedback to business impact.

Choosing the Right Research Method

Once you have that crystal-clear objective, picking the right qualitative method becomes way easier. Your choice should line up directly with the kind of information you need to uncover. Each method is like a different lens, giving you a unique perspective on your customer's world.

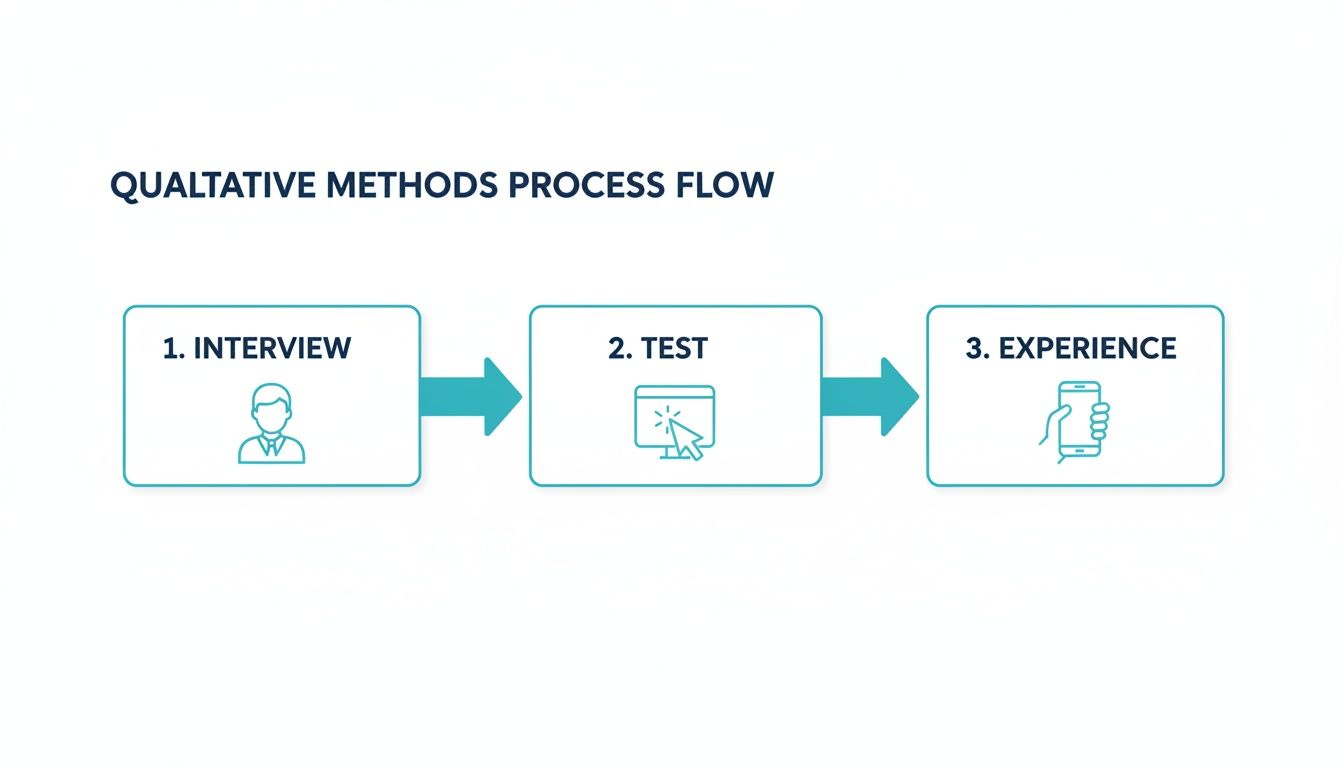

This flow chart gives you a simple way to think about which method to choose based on what you need to learn.

As the diagram shows, you might start with interviews to understand motivations, then move to usability testing to observe specific actions, and finally conduct experience studies to see how your brand fits into a customer's real life.

Key Takeaway: A usability test is perfect for finding where a problem exists (like a confusing button). A customer interview is essential for understanding why that problem causes frustration and leads to a lost sale.

Crafting Questions That Uncover Psychological Drivers

The real magic of qualitative research happens when you ask open-ended questions that get people telling stories. Your goal isn't to get a "yes" or "no." It's to get the participant talking, recalling specific experiences and the feelings attached to them.

You have to avoid leading questions that hint at a "right" answer, like, "Was our checkout process easy?" That just frames the conversation and gives you biased feedback. Instead, use neutral, exploratory prompts that invite them to share a detailed narrative. This is how you start collecting valuable zero-party data straight from the source. To get a better handle on this, check out our guide on what is zero-party data and how it powers personalization.

Sample Question Scripts for E-commerce Brands

Here are some powerful, open-ended questions designed to get at the psychological drivers behind buying decisions.

To understand purchase motivation and urgency:

- "Walk me through the last time you bought something online that you were really excited about. What was happening that day?"

- "Can you describe a time you felt a strong, almost impulsive urge to buy something? What was creating that feeling for you?"

- "Tell me about a product you almost bought but didn't. What was holding you back in that final moment?"

To uncover website friction and anxiety:

- "Thinking about your recent visit to our store, was there any point where you felt unsure or confused about what to do next?"

- "Describe your thought process as you were looking at the shipping and payment options. What were you looking for?"

By focusing on past behavior ("Tell me about a time when..."), you ground the conversation in actual experiences. This gives you far more reliable insights than just asking for opinions or predictions about the future. Putting in this work upfront ensures your research is set up to deliver findings that will directly improve your business strategy.

Analyzing Customer Insights and Turning Why Into Revenue

Getting customers to share their stories is just the opening act. A pile of raw interview transcripts and usability test notes is a lot like a kitchen full of fresh ingredients—the magic doesn't happen until you start cooking. The real value comes from sifting through those individual comments and transforming them into a clear roadmap for growth.

This is the part where you zoom out from one-off anecdotes and start seeing profitable patterns. The goal isn't just to listen. It's to systematically pull out the recurring themes, unspoken motivations, and emotional triggers that are quietly steering your business.

From Raw Notes to Actionable Themes

The most foundational technique for making sense of all this qualitative data is a process called coding, or tagging. Think of it like finally organizing that messy closet. Instead of shirts and shoes, you're sorting through customer quotes, observed behaviors, and emotional reactions from your research sessions.

You simply go through your notes and transcripts, applying short, descriptive tags to key moments. This process helps you see the forest for the trees, revealing the most common—and most impactful—themes hiding in plain sight.

- Initial Pass: First, just highlight anything that jumps out at you. A flicker of frustration, a statement of desire, a moment of pure confusion.

- Creating Codes: As you find similar ideas, group them under a single code. For instance, comments like "I couldn't find the shipping cost," "the final price was a surprise," and "delivery was more than I expected" can all get tagged with something like

price_anxiety. - Identifying Themes: After you've coded everything, you’ll start to see that some tags show up way more than others. These frequently used codes point directly to your core themes—the biggest opportunities and pain points your customers are consistently running into.

Common E-commerce Themes to Look For

While every brand has its own quirks, there are a few powerful psychological drivers that pop up again and again in e-commerce research. As you dig through your data, keep an eye out for these big ones:

- Decision Paralysis: You’ll hear customers talk about feeling overwhelmed by too many options, which often leads them to just give up and leave. This is a massive signal to simplify the path to purchase.

- Need for Social Proof: Shoppers will mention looking for reviews, hunting for "best-seller" badges, or trying to see what other people have bought. This points to a deep-seated need for validation before they're willing to pull the trigger.

- Fear of Missing Out (FOMO): Listen for language around scarcity, exclusivity, or the worry that a popular item might sell out soon. This is a potent emotional trigger that feeds directly into effective urgency marketing.

- Trust and Security Concerns: You'll see people hesitate when it's time to enter their credit card info or hear them voice concerns about whether a site looks legitimate. These are critical findings for preventing last-minute cart abandonment.

The industry is waking up to just how important this "why" is. In fact, 57% of market researchers have seen a rising demand for these kinds of qualitative methods. At the same time, 53% are boosting their CX research budgets to finally understand the psychology behind the staggering 40-60% cart abandonment rates that plague so many Shopify stores. And with 47% of researchers now using AI to analyze this type of unstructured data, it's easier than ever to turn hours of conversations into clear insights. You can see more on how the industry is adapting in these market research statistics.

Synthesizing Findings for Business Impact

Once you’ve nailed down your core themes, the final step is to connect them to specific business actions that actually make you money. This is how customer research stops being an interesting side project and becomes a core part of your growth engine.

A simple synthesis template can help you bridge the gap between what you heard and what you should do next.

Insight: "Multiple users expressed anxiety about choosing the 'wrong' jacket from our new collection and mentioned looking for the most popular one."

Psychological Driver: Need for social proof; decision paralysis.

Business Action: Use a Quikly ranked offer campaign for the jacket collection, highlighting the "#1 Best-Seller" to guide choice and create urgency around the most popular option.

This kind of structured approach makes sure every insight leads somewhere useful. Once you've analyzed your customer insights, the next step is often to optimize your site for conversions. Understanding the 'why' behind user actions is crucial for successful Conversion Rate Optimization (CRO). By tying your qualitative findings directly to strategic moves—whether it's tweaking your website, refining your messaging, or launching a targeted urgency campaign—you create a repeatable system for turning customer understanding into real, measurable revenue.

Applying Psychological Insights to Urgency Marketing

This is where the rubber meets the road. The themes and psychological drivers you dig up in your research become the raw ingredients for crafting urgency that actually feels authentic. It’s how you graduate from slapping a generic countdown timer on a page to building sophisticated, revenue-focused campaigns that connect on a much deeper level.

When you align your strategy with what really makes your customers tick, your promotions suddenly have teeth.

Generic urgency is just noise. Shoppers have become experts at tuning out a basic "Sale Ends Soon!" banner because it’s not speaking to them personally. But when you ground your approach in real human insight, you can tap into their specific anxieties and motivations, creating a pull that’s hard to ignore.

From Generic Banners to Resonant Campaigns

Let's walk through a concrete before-and-after. Say your quantitative data shows a ton of people bailing on a product page that has a lot of similar options. You know the what, but you need to find out the why. So, you run a few customer interviews.

Before Qualitative Research:

- Tactic: A generic "Sale Ends Soon!" banner plastered across the whole category.

- Psychology: A weak stab at scarcity that completely misses the real problem.

- Result: It does next to nothing for conversions. Why? Because it doesn't help the customer who's feeling totally overwhelmed by choice.

But then your qualitative research reveals a common thread: decision paralysis. You hear people say they’re afraid of picking the "wrong" thing and that they actively hunt for social proof to feel more confident. That one insight changes the entire game.

After Qualitative Research:

- Tactic: A Quikly campaign with a ranked offer. The messaging shifts to: "Our Top-Rated Pick is Almost Gone! Join 500+ happy customers."

- Psychology: This hits all the right notes. It uses social proof ("Top-Rated Pick," "500+ customers") and scarcity ("Almost Gone!") to cut right through that decision paralysis.

- Result: You're no longer just creating fake urgency; you're actively helping customers make a choice they feel good about. This simple shift addresses the core psychological barrier, leading to a serious lift in conversions and revenue.

This is the power of understanding your customer's mindset. You build campaigns that solve their problems while hitting your own business goals. If you want to go deeper on this, check out these core insights on the psychology of urgency marketing.

Tailoring Offers to Specific Drivers

Your qualitative findings are a roadmap to the behavioral triggers that matter most to your audience. This is how you fine-tune every part of a campaign for the biggest possible impact.

- If you find a strong need for social proof: Lean into ranked offers, show how many people are looking at an item, or make best-sellers the star of your urgency messaging.

- If you uncover a serious case of FOMO (Fear of Missing Out): This is your cue to run limited-edition product drops or offer time-boxed exclusive access to your most loyal customers.

- If price anxiety is a huge barrier: Frame your offers around loss aversion. "Don't miss out on 30% off" lands with much more impact than a simple "Sale" banner because it triggers the fear of losing a great deal.

By connecting your marketing directly to what your customers are feeling, you get to stop using blunt instruments and start being a helpful guide. It’s how you build trust and protect your profit margins at the same time.

Your Questions About Customer Research Answered

Jumping into qualitative customer research can feel like a huge undertaking, especially when you’re already juggling the million other things that come with running an e-commerce brand.

Let’s tackle some of the most common questions and hesitations. My goal here is to demystify the process and show you how doable this really is.

How Much Time and Budget Does This Really Take?

This is usually the first question people ask, and the biggest perceived hurdle. The good news? Qualitative research is surprisingly scalable. You don't need a massive budget or an in-house research department to get started.

You can kick things off with a "lean" approach by conducting just three to five customer interviews over a single week. You'd be amazed, but a small sample like that is often enough to flag 80% of the major usability problems or uncover the core motivations driving your customers. The time investment is mostly up-front—planning the study and finding people to talk to—but the payoff from sidestepping a costly website mistake or finding that one perfect messaging angle is almost immediate.

Where Do I Find People for My Study?

Finding the right people is way easier than you might think. You're already sitting on a goldmine of potential participants: your own customers and site visitors.

- Recent Customers: Send a quick email to customers who bought something in the last 30 days. The experience is still fresh in their minds, and most are happy to chat in exchange for a small gift card.

- Cart Abandoners: For Shopify Plus stores, you can use an exit-intent popup on your checkout page to catch visitors right before they bounce. Offer a small incentive for a 15-minute chat about why they were leaving.

- Email & SMS Lists: Your existing marketing channels are perfect for this. Use a platform like Klaviyo or your preferred SMS tool to segment and recruit specific types of customers you want to hear from.

How Do I Know if I'm Asking the Right Questions?

The trick is to ask open-ended questions that get people telling stories, not just giving one-word answers. Always focus on what they've done in the past, not what they think they might do in the future.

For example, instead of asking, "Do you like our checkout process?"—which just begs for a simple "yes" or "no"—try this: "Can you walk me through the last time you bought something on our site? Tell me what was going through your head at each step." This simple shift gets you the emotional and psychological journey behind the clicks, which is where the richest insights are hiding.

A great question reveals the story behind a click. It uncovers the hesitation, the motivation, and the final trigger that led to a decision—insights that are pure gold for optimizing revenue and customer loyalty.

Ready to turn those valuable customer stories into high-converting campaigns? Quikly is the expert in urgency marketing science, helping you apply the principles of consumer psychology to build campaigns based on real behavioral drivers. We move way beyond basic timers to generate real revenue and enhance the entire shopper journey. Discover how at https://hello.quikly.com.

The Quikly Content Team brings together urgency marketing experts, consumer psychologists, and data analysts who've helped power promotional campaigns since 2012. Drawing from our platform's 70M+ consumer interactions and thousands of successful campaigns, we share evidence-based insights that help brands create promotions that convert.