Unlocking Profit by Reducing Your Cost of Carrying Inventory

The cost of carrying inventory is the silent killer of profit margins.

It's the total sum of every single expense you rack up just for holding onto unsold stock. This isn't just a number for your accountant—it typically consumes 20% to 30% of your inventory's total value, quietly draining cash that could be fueling your growth. Understanding and controlling this cost is fundamental to protecting your ROI.

What Are Your True Inventory Holding Costs?

Picture this: every unsold product sitting on your warehouse shelf isn't just an item. It's a stack of cash you can't touch, spend, or reinvest. Worse yet, that stack of cash is shrinking every single day it sits there.

That's the reality of carrying costs. For a Shopify store owner, getting a grip on this metric isn't just a good idea; it's fundamental to staying profitable. These aren't one-and-done expenses, they're the ongoing costs that pile up long after you've paid your supplier, directly hitting your bottom line.

To truly understand what you're up against, you have to break these costs down.

The Four Core Components of Carrying Costs

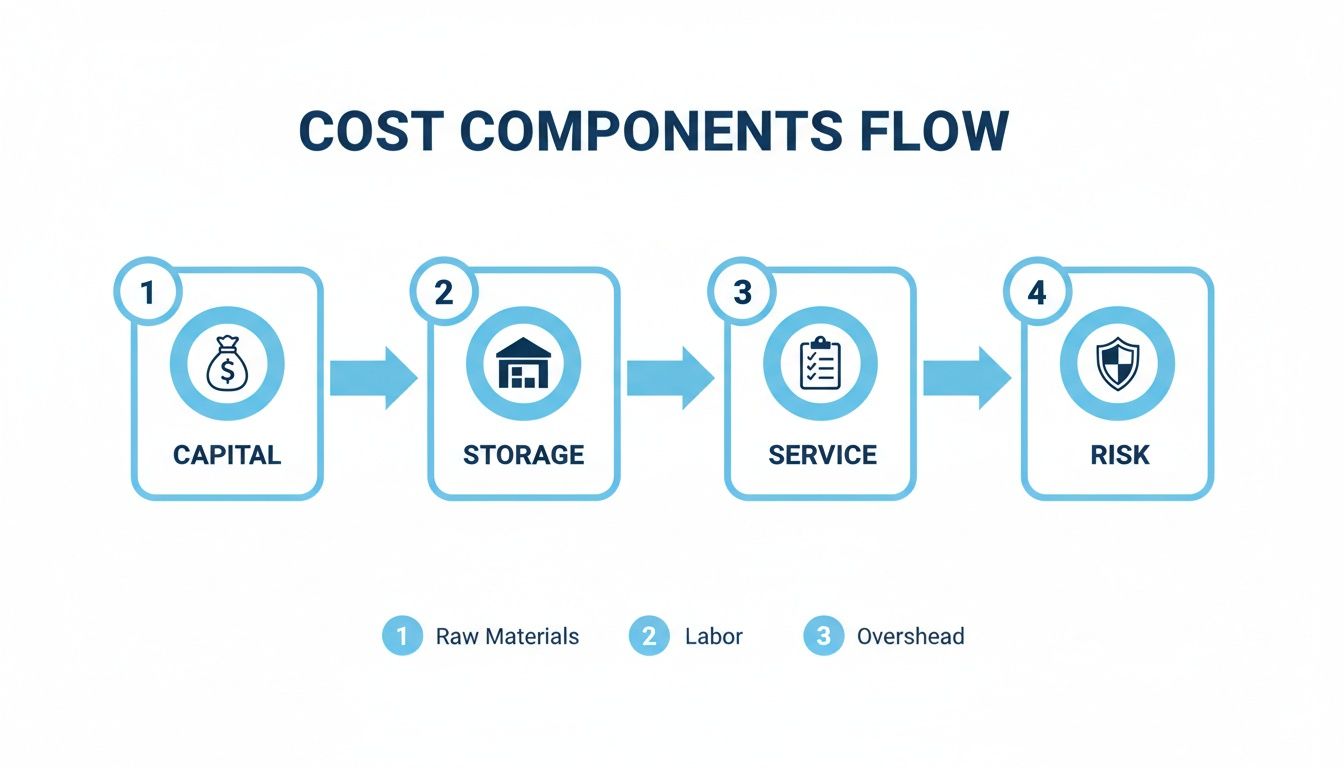

Most inventory holding costs fall into four main buckets: Capital, Storage, Service, and Risk. Let's unpack what each one actually means for an e-commerce brand.

To give you a quick, scannable overview, we’ve broken down the four primary categories of carrying costs in the table below. It summarizes what the metric really includes and provides some tangible examples you’d see in a real Shopify store.

| Cost Category | Description | Examples for a Shopify Store |

|---|---|---|

| Capital Costs | The opportunity cost of the money tied up in your inventory. This is cash that could be working for you elsewhere. | - Interest paid on loans used to buy stock - Lost investment returns from capital stuck in inventory instead of being in the bank or reinvested in marketing. |

| Storage Costs | All the direct expenses related to physically housing your products until they're sold. | - Warehouse rent or mortgage payments - Fees from a 3PL (third-party logistics) provider - Utilities (electricity, heating, cooling) - Salaries for warehouse staff |

| Service Costs | The costs associated with managing, handling, and protecting your inventory. | - Insurance premiums to cover theft, fire, or damage - Subscription fees for inventory management software (like an IMS or WMS) - Taxes paid on the value of held inventory |

| Risk Costs | The potential financial losses from inventory that can't be sold at full price—or at all. | - Shrinkage: Loss from theft, fraud, or damage - Obsolescence: Products becoming outdated or going out of style - Spoilage: Perishable goods expiring before they can be sold |

Thinking about these costs in isolated buckets helps clarify just how much you’re spending. When you add them all up, the numbers can be staggering.

On a national scale, these expenses represent a massive financial weight. In the United States, inventory carrying costs make up a whopping 28.5% of all business logistics costs. We're talking billions of dollars spent every year by businesses just to hold onto their products.

With warehouse rents and labor rates constantly on the rise, this pressure isn't going away. It's a top-of-mind issue for e-commerce brands everywhere. For a deeper dive into the latest logistics trends, you can discover more insights about 2024 logistics expenses.

How to Calculate Your Inventory Carrying Cost

Getting a handle on the theory is one thing, but turning those carrying costs into a real, tangible number is the first step toward actually controlling them. It might sound complicated, but figuring out your inventory carrying cost boils down to a straightforward formula that pulls back the curtain on what you're spending to hold onto unsold stock.

This number is a critical health metric for your business.

The core formula is simple:

Inventory Carrying Cost % = (Sum of All Inventory Costs / Total Average Inventory Value) x 100

This percentage tells you exactly what it costs to hold one dollar's worth of inventory for a full year. For most e-commerce businesses, a healthy benchmark is somewhere between 20% and 30%. If your number is creeping higher than that, it's a massive red flag that your excess stock is actively eating into your profits.

Breaking Down the Formula Components

To get your magic number, you first need to tally up all four of those cost components we just talked about. You'll typically want to look at these over a one-year period.

- Capital Costs: This is the opportunity cost of having your cash locked up in products. Think about any interest you paid on loans to buy that inventory, plus the potential returns you missed out on by not investing that money somewhere else.

- Storage Costs: These are the direct, out-of-pocket expenses for just housing your products. Add up your annual warehouse rent, any fees from a 3PL provider, utilities, and the labor costs associated with your warehouse team.

- Service Costs: This is the price tag for managing and protecting all that inventory. It includes your yearly insurance premiums and any subscription fees for inventory management software.

- Risk Costs: This is where you account for the potential losses from inventory that you'll never be able to sell. You'll need to estimate the value lost to shrinkage (theft or damage) and obsolescence (products that are now outdated or out of season).

This flowchart helps visualize how all these separate, often-overlooked expenses flow together to create your total carrying cost.

It’s a powerful reminder that the final number is a sum of many smaller parts, all of which directly chip away at your profitability.

A Practical Example for a Shopify Store

Let's make this real. Imagine a Shopify store that, on average, holds $200,000 worth of inventory throughout the year.

Here’s a plausible breakdown of their annual holding costs:

- Capital Costs: $20,000 (from interest and lost investment opportunities)

- Storage Costs: $15,000 (covering 3PL fees and warehouse utilities)

- Service Costs: $5,000 (for insurance and software subscriptions)

- Risk Costs: $10,000 (accounting for shrinkage and obsolete stock)

- Total Inventory Costs: $50,000

Now, we just plug those numbers into our formula:

($50,000 / $200,000) x 100 = 25%

What does this mean? For every single dollar of inventory this store has sitting on a shelf, it’s spending 25 cents per year just to keep it there.

Pinpointing this number is an eye-opening first step. The next is figuring out how to lower it, which all comes down to moving stock more efficiently. A key metric for tracking that efficiency is your inventory turnover rate. You can dive deeper into how to master your inventory turnover rate calculation in our detailed guide.

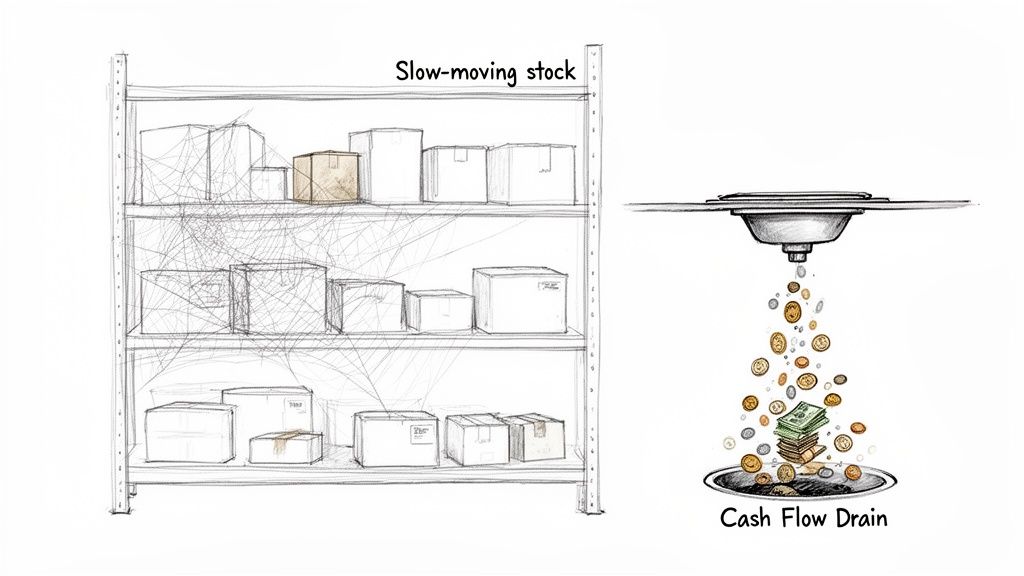

The Hidden Ways Excess Inventory Drains Your Business

High carrying costs aren't just a number on a spreadsheet. Think of them as an anchor, weighing down your business's ability to move quickly and grow. When cash is tangled up in slow-moving stock, it isn't just sitting there doing nothing—it's actively stopping you from jumping on real opportunities.

Every dollar trapped on a warehouse shelf is a dollar you can't put into a revenue-generating marketing campaign, test a new product, or expand into that market you've been eyeing.

This cash flow squeeze creates a nasty feedback loop. Without capital, you can't fund the marketing you need to sell the very products that are tying up your money in the first place. It's a kind of financial paralysis, and it often starts with a psychological trap many e-commerce founders fall into.

The Domino Effect of Over-Ordering

The fear of stocking out is real. Especially after the supply chain chaos of the last few years, it's easy to develop a "just-in-case" mindset. It feels like the smart, safe move, but it can kick off a domino effect of financial strain. You end up with a mountain of products that not only fail to make you money but actively cost you money every single day.

This isn't a small problem—it's become a huge financial burden for retailers. On average, a business holds $142,000 worth of inventory more than it actually needs to meet demand. With interest rates and warehouse rents climbing, that surplus is getting more expensive by the minute. For a closer look at these rising costs, you can learn more about recent inventory management statistics.

From Asset to Double Liability

When you look at this slow-moving stock next to some industry benchmarks, the picture gets even scarier. The average e-commerce cart abandonment rate hovers around 70%. That means every product already has a tough fight to get sold. For slow-movers, the odds are much, much worse.

This is where a product flips from a potential asset into a double liability. It's racking up carrying costs while simultaneously failing to bring in the cash needed to cover them.

This quiet drain on your profits is one of the biggest hidden dangers of a high cost of carrying inventory. Each day a product sits unsold, it gets more expensive to hold and less likely to sell at full price, digging you into a deeper hole. To fix this, you have to go beyond basic inventory counts and start using strategies that turn that dead stock back into what it was always supposed to be: cash.

Why Basic Inventory Management Just Doesn't Cut It Anymore

Trying to run a modern Shopify store using spreadsheets and the occasional manual stock count is a bit like navigating rush hour traffic with a paper map from 2005. It’s not just inefficient anymore—it's a genuine threat to your profitability. E-commerce moves way too fast for that.

This old-school approach is a recipe for poor demand forecasting. Without real-time data, you're essentially guessing what your customers want. It creates a painful cycle: you run out of your bestsellers and end up with a mountain of products nobody’s buying. The result is a double-hit to your bank account—missed sales on one side, and a rapidly growing cost of carrying inventory on the other.

The Growing Burden on Small Businesses

For small and medium-sized businesses, the fallout from messy inventory is especially rough. Most smaller brands don't have huge cash reserves to absorb the cost of products just sitting on a shelf. Every dollar tied up in stagnant stock is a dollar you can't use to grow your business.

And this isn't a niche problem. Recent research shows that for the average SMB, excess stock has ballooned to 38% of their total inventory over the past year. This pile-up is a hangover from supply chain chaos and brands overcorrecting, creating a massive financial strain that goes far beyond just storage fees. You can dive deeper into the data by reading the full research on global SMB inventory trends.

This isn't just a minor operational headache. It's a strategic bottleneck. When nearly 40% of your inventory's value is dead weight, your ability to invest in marketing, develop new products, or acquire new customers gets choked off.

At the end of the day, these outdated systems create painful friction everywhere. They kill your visibility, slow down your decisions, and force you to constantly react to inventory fires instead of preventing them in the first place. To actually thrive, modern e-commerce stores have to switch to smarter, data-driven solutions that turn inventory from a liability into a real competitive edge.

Proven Strategies to Lower Your Inventory Carrying Costs

Knowing that high carrying costs are a slow leak in your company’s finances is one thing. Actually plugging the hole is another. The good news is that reducing your cost of carrying inventory isn't about making wild, risky cuts. It’s about being smarter and more agile. This is where you pivot from putting out fires to proactively building a more profitable business.

The real aim here is to crank up your inventory turnover. You want products flying off the shelves and into your customers' hands, not sitting around collecting dust. When you get this right, you free up cash, minimize risk, and give your bottom line a direct boost.

Let Data Drive Your Inventory Decisions

Going with your gut or relying on last year's spreadsheets just doesn't work anymore. If you want to make a real dent in your carrying costs, you need to start with hard data. Digging into your sales velocity and the value of each product lets you make surgical decisions that have a surprisingly big impact.

Here are three foundational, actionable tactics you can implement today:

- Run an ABC Analysis: This is a classic for a reason. It’s a method of categorizing your inventory by its value to your business. Your ‘A’ items are the superstars—high-value, top-selling products. ‘B’ items are your solid mid-range performers. And ‘C’ items are the low-value products you sell in high quantities. This simple framework helps you focus your energy where it counts, ensuring your bestsellers are always in stock while preventing you from tying up too much cash in less critical items.

- Dial-In Your Reorder Points: Set up automated reorder points based on real sales history and how long it takes your suppliers to deliver. This is the secret to avoiding two expensive problems: frustrating stockouts and bloated safety stock. A finely tuned system orders just enough inventory, right when you need it.

- Get Better at Forecasting Demand: Dive into your Shopify analytics and customer data to get a clearer picture of what’s coming. When you start analyzing sales trends, seasonal spikes, and how past marketing campaigns performed, you can align your purchasing with what your customers are actually going to buy.

To really sharpen your approach and get your stock flowing efficiently, it's worth exploring these 10 actionable inventory management best practices.

Use Smart Marketing to Speed Up Turnover

Fixing your operations is critical, but don't forget you can also market your way out of an inventory problem. Instead of watching slow-moving products rack up costs, you can flip the script and turn them into an opportunity for revenue and customer excitement. This is where urgency marketing, which taps into fundamental behavioral economics, becomes your best friend.

The key is not to slash prices and kill your profit margins. It's about creating genuine demand through strategic urgency. By leveraging psychological principles like scarcity (limited quantity) and FOMO (fear of missing out), you can motivate people to act now, turning that idle stock back into cash.

Think about it: a well-executed limited-time product drop could liquidate a slow-moving item in a matter of hours, not months. Just like that, you stop the bleeding from carrying costs on that product and get a welcome injection of cash back into your business.

For a deeper look at optimizing your stock flow, check out our guide on implementing a barcode inventory management system. By marrying smart operational tactics with psychologically-driven marketing, you create a powerful system for keeping carrying costs down and profitability up.

Comparing Inventory Reduction Tactics

When you're deciding how to offload excess inventory, it's a balancing act between clearing space and protecting your profits. Not all methods are created equal. Some are fast but will cost you in margins, while others are slower but preserve the value of your brand and products.

Here’s a quick comparison of the most common tactics to help you decide which lever to pull.

| Tactic | Impact on Carrying Cost | Impact on Profit Margin | Best For |

|---|---|---|---|

| Deep Discounts/Sales | High (fast reduction) | High (significant margin loss) | Quickly liquidating seasonal or perishable goods. |

| Bundling | Medium (moves multiple items) | Medium (slight margin decrease) | Moving slow items by pairing them with bestsellers. |

| Urgency Marketing | High (creates quick demand) | Low (preserves perceived value) | Clearing specific SKUs without devaluing the brand. |

| Return to Vendor | High (immediate removal) | Varies (depends on agreement) | Products with return agreements, avoiding markdowns. |

| Donation/Liquidation | Highest (instant removal) | Highest (total or near-total loss) | End-of-life products or clearing warehouse space. |

Ultimately, the best approach often involves a mix of these strategies. By understanding the trade-offs, you can make smarter decisions that clear out dead stock without sacrificing the long-term health of your business.

Using Urgency Marketing to Convert Idle Stock Into Revenue

When a product sits on the shelf too long, it starts to feel like a liability. The knee-jerk reaction for many brands is to slap a huge discount on it, hoping to just get it out the door. But this can be a race to the bottom, eroding your profit margins and training customers to wait for a sale.

There’s a much smarter way to handle this—one that’s rooted in behavioral psychology, not steep markdowns. You can turn that slow-moving stock into a genuine revenue opportunity without devaluing your brand in the process.

This is the science of urgency marketing. It’s far more sophisticated than a basic countdown timer. It’s about tapping into powerful psychological drivers like scarcity, anticipation, and social proof to create real, immediate demand for those specific items. Done right, this approach stops the bleeding from carrying costs and injects instant cash flow back into your business.

From Liability to Limited Drop

Instead of a broad, sitewide sale that feels desperate, you can create a focused, strategic event. Think of it as a limited-time product drop or what we call a "Moment." This tactic pulls all of your customers' attention toward one specific SKU and gives you the power to liquidate it in a matter of hours, not months.

By reframing "excess inventory" as a "limited opportunity," you protect your brand's perceived value. Customers aren't buying a discounted product; they're gaining access to an exclusive offer, a powerful psychological shift that drives action.

This is a surgical strike. It immediately stops the daily bleed from the cost of carrying inventory for that one item, boosting revenue and freeing up capital that was locked away in an underperforming asset.

Advanced Targeting for Shopify Plus Merchants

For enterprise-level brands on Shopify Plus, the impact of these campaigns can be massive, especially when integrated deeply with your existing marketing stack. Automated urgency campaigns can sync up perfectly with platforms like Klaviyo or your preferred SMS platform.

This opens the door for incredibly precise audience segmentation. Imagine launching a targeted "Moment" exclusively for:

- Past purchasers of a product that pairs well with the one you need to move.

- VIP customer segments who get early access as a perk.

- Shoppers who previously viewed the item but never pulled the trigger.

When you layer urgency with this kind of personalization, you’re giving hesitant browsers the exact nudge they need to become decisive buyers. Of course, driving traffic to these events is key, which is why having effective e-commerce advertisement strategies in place is so important.

This is a world away from basic pop-up apps that just capture an email. Instead of simply collecting leads for later, you’re generating immediate ROI, protecting your margins, and solving a core inventory management problem all at once. You can dive deeper into these principles with our guide on 10 urgency marketing tactics that actually drive sales.

Still Have Questions About Inventory Carrying Costs?

Let's clear up some of the most common questions Shopify store owners have when they start digging into the cost of carrying inventory.

What Is a Good Inventory Carrying Cost Percentage?

A healthy inventory carrying cost for most e-commerce businesses is 20% to 30% of the total inventory value. Think of this as your inventory health score.

If your calculation spits out a number well north of 30%, it's a significant red flag. It indicates that slow-moving or obsolete stock is actively eroding your profit margins. It’s time to take action.

This isn't a one-size-fits-all number. The benchmark can shift depending on your industry. If you're in fast fashion or deal with perishable goods, your risk costs are naturally higher, which will likely push your percentage toward the upper end of that range.

How Often Should I Calculate My Carrying Costs?

At a minimum, you should calculate your carrying cost annually. This provides a consistent, year-over-year benchmark to track your performance and validate your inventory management strategies.

However, for fast-growing brands or businesses in dynamic industries, a quarterly calculation is a smarter approach. It provides more current data, enabling you to react to market shifts, identify problem SKUs before they become major liabilities, and adjust your purchasing strategies with greater agility.

Can Reducing Carrying Costs Improve My Profit Margin?

Absolutely. There is a direct, causal relationship between lowering your carrying costs and boosting your profit margin.

Every single dollar you save on storage, insurance, tied-up capital, and obsolete stock flows directly to your bottom line.

Consider this: when you turn stagnant inventory into cash, you’re not just making a sale. You’re also stopping a financial leak. This double-win—generating new revenue while cutting off an ongoing expense—is one of the most powerful moves you can make to build a more profitable business.

This isn’t just an accounting exercise; it’s a core strategy for building a financially resilient e-commerce brand that's built to last.

Ready to stop the bleed from carrying costs and turn that idle stock into immediate revenue? Quikly uses the science of urgency marketing to create authentic demand, helping you liquidate specific SKUs without resorting to margin-killing discounts. See how our platform can transform your inventory challenges into profitable opportunities.

The Quikly Content Team brings together urgency marketing experts, consumer psychologists, and data analysts who've helped power promotional campaigns since 2012. Drawing from our platform's 70M+ consumer interactions and thousands of successful campaigns, we share evidence-based insights that help brands create promotions that convert.